Syndication loan is a financing offered by a group of lenders who committed to provide a financing with the same terms and condition under a single financing agreement. The key benefit for a syndication loan lender instead of bilateral loan is the diversification of credit risk from borrower to lender. Syndication loan arise due to the financing amount is too large for a single lender capital base. Syndicating the loan allows lead arranger to diversify the credit risk by inviting other lender to participate the same financing. In general, the lead bank may put up a proportionally bigger share of the loan amount and ask other lenders to take up the rest (i.e. syndicate the loan). Syndication loan is usually used for large corporate financing, project financing, merge and acquisition financing and leverage buyout financing.

Process

Syndication loan is a sequential process arose from business needs. A company would consider a syndication loan when it has a substantial financing needs which is one off and different from general pattern. The use of proceeds for the syndication loan included but not limited to general working capital, refinancing, capital investment for new project, merge and acquisition, etc. During the process, a company (“borrower”) solicits the relationship bank to form a syndication group and seek for the offering from relationship banks. At this point of time, a term sheet shall be provided by the invited relationship bank. After the borrower mandated a bank so call Lead Arranger or Mandated Lead Arranger and Bookrunner (“MLAB”) to arrange the syndication, the borrower shall negotiate the terms and detail of the loan with the MLAB. When fundamental detail is confirmed between MLAB and borrower, negotiation between the MLAB and participating banks (“participant”) kick off until all the terms are agreed by participants. Finally, a single loan agreement with agreed terms will be signed by all parties in order to bind all the interest in a single agreement.

Lender Roles

It is hard to understand by an outsider on the name of Mandated Lead Arranger, Arranger, Loan Agent, Underwriter, etc. In a syndication loan, there are roles for different function. The key player of a syndication is the lead coordinator – Mandated Lead Arranger and Bookrunner (“MLAB”).

MLAB play a pivot role and control the success of the syndication closing. MLAB is mandated by the Borrower to arrange the whole logistic of syndication including documentation, origination and distribution. MLAB will prepare a draft term sheet to negotiate with Borrower on the syndication and provide opinion what strategy should play in order to obtain the financing support from participating banks such as the interest rate level, fee level, tenor, covenants, banks being invited and collateral to be provided. First, MLAB will conduct structuring work which is base on the financing purpose to structure a financing that could fit the risk appetite of potential lenders. The structure of transaction is designed according to the borrower’s corporate structure, repayment sources, and financial data of borrower. Structuring is the most time-consuming part of a syndication and it is also the most important part to a syndication closing as a complicated financing is heavily rely on the structure to “Control” and “Mitigate” credit risk. After an in-depth analysis, MLAB shall confirm the Term Sheet with Borrower on the financing structure with pricing (interest rate and arrangement fee), covenants, conditions precedent, condition subsequent, monitoring mechanism, undertakings etc. After all the detail is being confirmed, MLAB shall arrange syndication presentation with potential participating bank with below documents:

- Term Sheet;

- Teaser

- Information Memorandum, and

- Due Diligence documentation package (could be substantial)

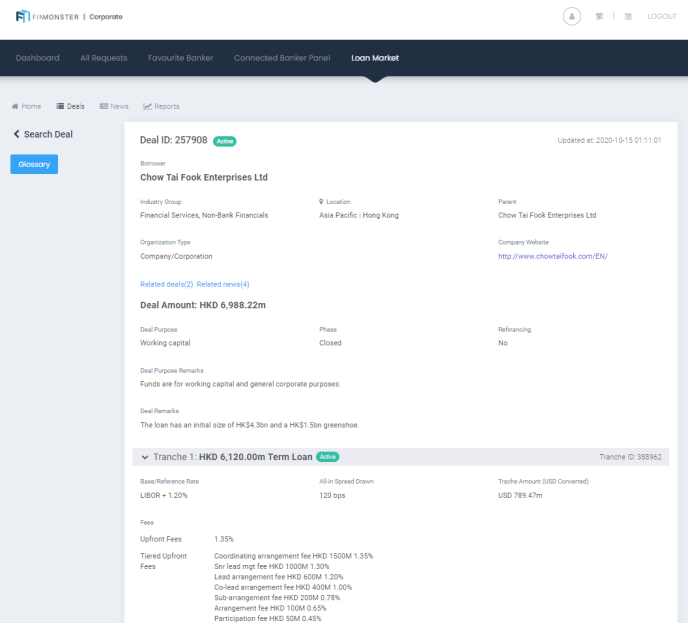

Facility agreement will be prepared by MLAB and Legal Counsel after sufficient subscription amount is received. During the syndication process, all logistics are basically handled by MLAB so that they are eligible to earn an arrangement fee and skim fee (to be elaborated in next article). From FinMonster information, as an example, Chow Tai Fook syndication loan is coordinated by MLAB Agricultural Bank of China.

Participating banks (“Participant”) are the lender who participate in the syndication invited by the Borrower. Participants usually are bank without existing relationship with the Borrower and wish to be a lender for the syndication loan. They are titled as Mandated Lead Arranger, Lead Arranger or Arranger based on the participating amount. Refer to the Chow Tai Fook deal information above, Lead Arranger is CMB Wing Lung Bank, Dah Sing Bank while others are arranger. Participant act as lender and wish to generate revenue by participating the syndication loan. After receiving invitation from MLAB, participant review the Term Sheet and Information Memorandum and relevant documents to assess the credit risk for approval. Participant only subscribes as long as approval from credit committee (or approver) obtained. Negotiation on the terms to be put into facility agreement sometime happen if approval is under conditions. After signing on the facility agreement, Participant must fund the proceed to facility agent and earn interest during the financing tenor. There is not much administrative work for Participant during the financing period except waiver or consent on facility agreement is required.

Loan Syndicate Agent (“Loan Agent”) is a lender who coordinate the transaction. The Loan Agent sometime refer to Facility Agent. Loan Agent is often responsible for the initial transaction, fees, compliance reports, repayments throughout the duration of the loan, loan monitoring, and overall reporting for all lenders. Taking the news from FinMonster about Lai Sun syndication, the facility agent is DBS Bank. A third party or additional specialists may be used throughout various points of the loan syndication or repayment process to assist with various aspects of reporting and monitoring. Since only a small amount of Loan Agent fee will be given, this role is not popular to Participants and most likely MLAB would take up the role.

Now FinMonster offer you the detail of loan market with benchmarking pricing, terms, lenders, news and analysis that powered by Refinitiv.All users enjoy a free 7-day trial.

You may be also interested: What is Syndication Loan? (Part 2)

FinMonster provides a one-stop platform for Corporates to quickly obtain suitable banking support and compare the best prices. We regularly share the latest banking and FinTech trends, as well as quick tips like info pack that helps SMEs financing. Stay tuned with our website and Facebook.